![The fear of rising US inflation is about [premium]](/wp-content/uploads/2021/02/die-angst-vor-einer-steigenden-us-inflation-geht-um-premium-9eaea9d.jpg)

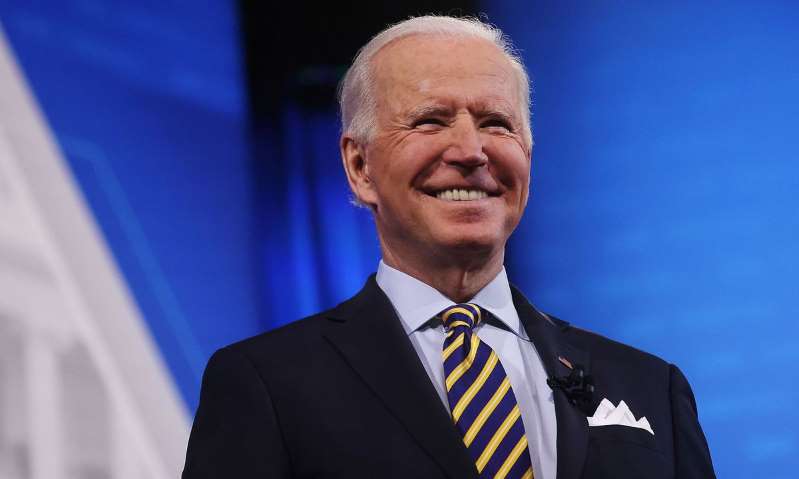

$ 1.9 trillion is set to save the American economy and help the country get back on its feet. At least if the new US President, Joe Biden, has its way. The Republicans do not want such extensive support measures, which is why the Democrats hope that a slim majority in both chambers will be enough for them to pass the stimulus package.

As helpful as a fiscal stimulus may be, in the United States it is already fueling worries of rising inflation among some economists. Former US Treasury Secretary Larry Summers warned of the potential for trillion dollar support against inflationary pressures on a scale “we haven't seen in a generation”.

In fact, inflation expectations in the US have risen recently. The market is pricing in an inflation rate of around 2.2 percent for the next ten years. That may seem like a lot at first glance, “because we are coming from a phase in which it was common for us to be surprised by the downward inflation rates,” says RBI analyst Franz Zobl. But an inflation rate of around two percent is exactly the same level that the US Federal Reserve once set itself the target.

With rising inflation expectations, nominal yields on the US bond market have also risen. In the ten-year period, they have climbed to around 1.3 percent, their highest level in a year. A movement that began last quarter and has now picked up speed. If inflation rises, one could assume that the economy will also pick up and with it the general interest rate level, which makes low-interest bonds unattractive.

Labor market factor

However, the US Federal Reserve long ago announced that it would not touch the key interest rate until 2023. Whether or not she follows her own prognosis is another piece of paper. However, it has no pressure to act when it comes to inflation. Because last year it announced that it would allow the inflation rate to temporarily overshoot. “Although she has not specified what temporary means, nor to what extent inflation can rise,” says RBI expert Zobl. The analyst assumes that the central bank will first wait to see “whether the fear of high inflation will come true”. Special effects, such as the recent rise in the price of oil, will initially affect the rate of inflation. In March and April one will see increases in the US inflation rate.

“But the Fed does have the instruments to fight inflation,” says Zobl. But she has to use them carefully. Interest rate hikes can curb the rise in inflation, but such a step can also stall the economy and thus the US labor market. In addition to price stability, the Fed is also keeping an eye on the labor market (and most recently this). And things are not looking particularly good there at the moment. “Employment in the USA is still well below the pre-crisis level, and the unemployment rate is higher,” said Zobl.

Which is why the American central bankers will be careful not to intervene too quickly. Even if the participants in the financial markets are likely to exert pressure in this direction.

[R7DRB]