In early December, the Ministry of Social Policy published a draft pension reform. What could change for Ukrainians if approved, the main and important points — in the material of Fakty ICTV pension expert Sergey Korobkinand volunteer lawyer of the Hotline of the Ukrainian Bar Association on issues related to military aggression, its consequences and martial law, lawyer of the ARES law firm Evgeniy Promsky.

- Pension reform: what it implies

- Pension reform: additional payments and all sorts of extensions

- Pension reform in Ukraine: how the recalculation will take place

- Pension reform: changes

- Cumulative pension system

- When the reform will work?

- Pension reform in Ukraine: what are the pros and cons

Pension reform: what does it imply

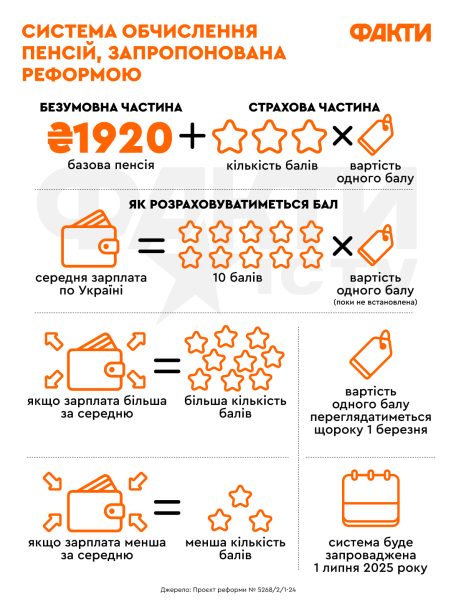

First of all, the pension reform provides for the introduction of a point system from July 1, 2025. According to the new formula, the pension will consist of two parts. The first, basic, is 30% of the minimum wage, taking into account taxes.

< p > – For example, today the minimum is 8 thousand UAH. In fact, a person receives about 6,400 UAH. 30% of this amount will be 1,920 UAH. Not much, but this is the basic amount that the state will guarantee from the budget to any person who has the right to a pension, – notes pension expert Sergei Korobkin.

Now watching < p > According to him, then the second insurance part, which will be determined by the new formula, will be paid up to these almost 2 thousand. In it, the length of service coefficient disappears altogether, and the salary coefficient is also removed.

— The main thing is to count how many points a person has. And then multiply by the point value. The principle of determining a point is very similar to the principle of determining the salary coefficient. If you received the same salary this month as the national average, then you will be awarded 10 points. And so every month throughout life, a person will accumulate points, – the expert explains.

He notes that if the salary is less than average, then there will be fewer points accordingly. If the salary is more than average, then there will be more points.

— Simply put, the salary coefficient for each month simply needs to be multiplied by 10. If a person worked for 35 years and received an average salary, then he conditionally accumulated 4,200 points during his life. That's 420 months at 10 points. Well, then you need to multiply the points by the cost of one point, said Sergey Korobkin.

That is, according to the expert, the ideal formula assumes that the cost of a point will be 30% of the average salary for the previous year, divided by 4200. That is, there is a link to the ideal average indicator.

According to this formula, in 2024, the cost of a point could be equal to approximately 80 kopecks for everyone. If we multiply them by 4,200 points, by the average value, we get an insurance part of UAH 3,360. And to this amount we add the basic part of UAH 1,920. Thus, together we get almost UAH 5,300.

– Today, such a person can receive much less if he retired a long time ago. This is due to different retirement times. According to the new formula, a person's insurance pension increases, and the basic pension is added to it. But while the transition period lasts, as far as I understand, the Cabinet of Ministers will manually set the cost of a point slightly lower than prescribed in the formula. Because raising the pension, say, from UAH 2,800 to UAH 5,300 at once will be quite difficult for the current budget, says Sergey Korobkin.

The expert notes that the increase in pensions under the new formula may occur gradually. And first of all, it should affect payments that were assigned a long time ago. The increase in the pension that a person has recently received may be artificially slowed down for several more years.

The reform states that until 2030, when determining the cost of a point, a financial stability correction coefficient will be applied, which will be reviewed annually from March 1.

Pension reform: additional payments and all sorts of extensions

As the expert notes, when switching to the new formula, various additional payments and extensions will disappear, including such a concept as additional payment for overtime work experience. But this should be imperceptible due to the fact that the insurance pension is increasing, and the basic part is added to it.

Pension reform in Ukraine: how will the recalculation take place

According to the new rules, the pension must be recalculated every year. Due to the change in the minimum, the basic part will automatically increase, and as a result of the increase in the average salary, the cost of the point and the insurance part of the pension will automatically increase. Thus, indexation will be more equal and fair for everyone. Although it will no longer take into account the inflation rate.

– If the average salary does not grow, then the pension will not grow accordingly either. This model exists in European countries, where pensions may also decrease due to a decrease in the average salary. A kind of indexation in reverse. However, from year to year the average salary in Ukraine is constantly growing, notes a pension expert.

Working people will receive their pensions automatically every year from March 1, taking into account the additional points received.

– Currently, such recalculations are made only once every two years and very often without taking into account salaries, but only length of service. In general, the reform adds weight to the official salary. The main thing is to pay more contributions. And length of service, in general, will only be required to determine the right to a pension in order to retire on time.

Even if a person does not have the 15 years of service required to retire at 65, such a right may arise if the person had a good salary for a short period of work and accumulated 1440 points, — notes a pension expert.

Pension reform: changes

Preferential work experience may be cancelled. Also, the section on disability pensions is effectively disappearing from the law.

The draft also stipulates that pensions for length of service will be paid until a professional savings system is introduced.

The amount of the funeral benefit for a pensioner will now be determined by the Cabinet of Ministers, that is, it will not be stable, as it is now, in the amount of two pensions of the deceased.

Pensions that exceed the maximum, that is, more than 23 thousand UAH, are to be limited for the duration of martial law. This concerns pensions for Chernobyl victims, military personnel and civil servants.

— Those pensions that exceed 23 thousand UAH are to be cut by an amount from 20% to 60%, depending on how much the pension exceeds the maximum. But this is only about the time of martial law. And I did not see in the project about similar restrictions for judges and prosecutors, — noted Sergey Korobkin.

Accumulative pension system

The reform provides for the introduction of a mandatory accumulative level of the pension system. It is assumed that within the reform, individual pension accounts will be opened for each working Ukrainian, which will be replenished monthly by employers and the state. The accumulation fund, which will manage these funds, will invest them in order to protect them from inflation and increase them.

Access to accumulation deposits will open only after retirement, that is, at the age of 60 with 35 years of work experience.

In the first year after the reform, the contribution to the savings fund will be 2-3% of the salary: 1% each due to the corresponding reduction of the unified social contribution and personal income tax, and another 1% is the employee's voluntary contribution. However, the latter is voluntary only conditionally, since it will be charged automatically, but the employee will have the right to refuse it. To do this, it will be necessary to go through certain bureaucratic procedures.

In the future, the amounts of contributions due to personal income tax, the unified social contribution, and the amount of the employee's voluntary contribution will increase: in the second year to 2% (that is, the total contribution to the savings account will be up to 6%), and in the third year – to 3% (up to 9%).

From the fourth year after the start of the reform, only the contribution due to the unified social contribution will remain mandatory – 3%. However, if an employee expresses a desire to voluntarily pay a contribution to the savings fund from his salary, the state will duplicate it and transfer a similar amount to the savings account, but no more than 3% of the salary.

When the reform will work?

Currently, the reform is at the stage of approval by the relevant ministries and has not even been registered in the Verkhovna Rada of Ukraine as a draft law.

— Therefore, it is not relevant to talk about the introduction of this reform in practice at the moment, since changes may be made to the draft at the stage of consideration, and the duration of this consideration depends on many factors, — notes Evgeniy Promskiy.

Pension reform in Ukraine: what are the pros and cons

As noted in the explanatory note to the project, it will allow:

- to increase the level of pension provision for more than 80% of pensioners,

- to strengthen insurance principles in the system,

- to eliminate disproportions between the sizes of pensions assigned in different years,

- to simplify the calculation mechanism pensions,

- rethink the pension indexation mechanism,

- establish an automatic mechanism for accelerated pension growth during the country's economic growth,

- systematize all pension supplements in one law.

Such changes will ensure more adequate pension amounts, increase the fairness, clarity and financial stability of the solidarity system.

— However, given the significant deficit of funds in the Pension Fund of Ukraine and the State Budget of Ukraine, the prospect of increasing the pension size of Ukrainians is rather doubtful, — notes Evgeny Promsky.

He adds that the reform is intended to shift the burden of pension payments onto the citizens themselves, which will hurt those who receive preferential pensions (Chernobyl victims, workers in professions with difficult or harmful conditions, etc.). And how it will be in practice — time will tell.