Huawei suffers from the Android ban. Other manufacturers benefit from the manufacturer's crash.

The latest analyzes by market researchers show that there has been movement in the smartphone market. In addition, the latest figures make it clear that Huawei is being hit hard by US trade restrictions.

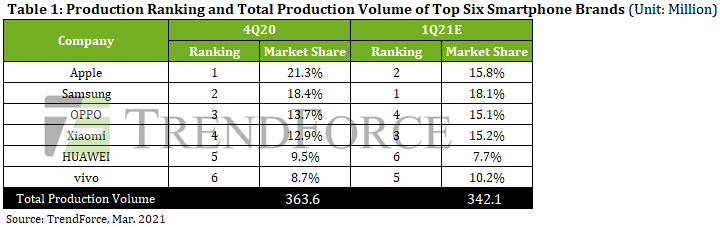

According to the Trendforce market analysis, Apple secured 1st place in the last quarter of 2020. With a market share of 21.3 percent, the iPhone manufacturer was ahead of Samsung with 18.4 percent and ahead of Oppo (13.7 percent) and Xiaomi (12.9 percent). Huawei comes in 5th place with a market share of 9.5 percent.

For Apple, the Christmas quarter is traditionally the time when most iPhones are sold. The new Apple devices are presented in good time every autumn.

Samsung again ahead of Apple

In the first quarter of 2021, things will look a little different again. The presentation of its top devices of the Galaxy S21 series at the beginning of January should have inspired Samsung. Because the Korean manufacturer was able to regain first place with a market share of 18.1 percent.

Apple is in 2nd place with 15.8 percent, ahead of Xiaomi (15.2 percent), Oppo (15.1 percent) and Vivo (10.2 percent). Huawei has continued to lose and only has a market share of 7.7 percent.

Huawei loses smartphone crown in China

Counterpoint's analyzes show a similar picture. However, the market researchers only looked at the Chinese smartphone market. There Huawei was ousted from 1st place.

Almost after four years, @oppo gained back # 1 spot in the China smartphone market that Huawei has dominated until nowhttps: //t.co/mKORssyM2X @CounterPointTR @ varun_m01 pic.twitter.com/XdiL8xEG6o

– tarun pathak (@Tarunpathak) March 5, 2021

Oppo has a market share of 21 percent in China, ahead of Vivo with 20 percent. Huawei, Apple and Xiaomi land in third place with 16 percent each.

Even if the Huawei devices that are sold on the home market have always been delivered without Google apps, the effects of the US trade restrictions are now likely to have arrived there as well.

Effects of the US embargo

Counterpoint points out that Huawei is now struggling to get the appropriate components for 5G-enabled smartphones. According to market researchers, this has seriously negative consequences.

In China, 65 percent of the cell phones sold are 5G-capable. If a manufacturer cannot meet the high demand for 5G smartphones, this will depress sales, writes Counterpoint.

Huawei tries with its own operating system

Huawei has been working on its own operating system for a long time. In April, the first smartphones are to appear, which are equipped with the in-house Harmony OS as standard.

In any case, it will be exciting to see how the Huawei P50 with Harmony OS is received by smartphone users. It remains to be seen whether the new top devices and the in-house operating system will be able to boost sales again.