Young hobby investors are challenging a hedge fund, but it now seems to be resorting to improper means. The stock market battle becomes a political issue.

The bronze statue erected in 2017

An unbelievable duel is coming to a head on the US stock exchange: Several thousand hobby investors are battling a powerful hedge fund with more than 12.5 billion dollars in management capital. In the meantime, the topic is also affecting US politics, as the major investors seem to be acting not only with fair means.

The history

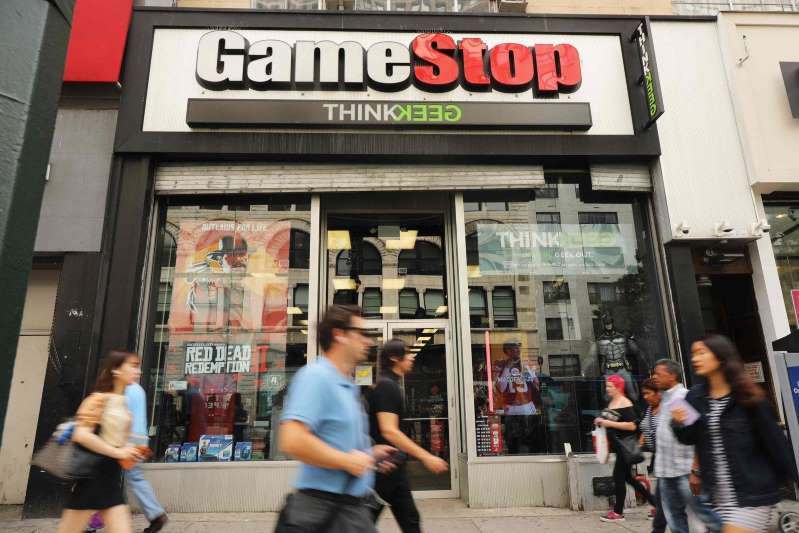

The well-known video game retailer Gamestop is doing badly. The international chain with its almost 50,000 employees specializes primarily in the purchase and sale of used video games. She had suffered for a long time, but the corona crisis accelerated the negative development again.

Several major investors on Wall Street have therefore bet that the price of the Gamestop share will soon fall significantly. This process is called shortselling – to put it simply: if the share loses value, investors make money. A lot of money. The hedge fund Melvin Capital has put a lot of money here on a price crash.

However, Gamestop is a company that is particularly popular with young people, and the Internet is also causing very special phenomena, especially during the corona pandemic, fueled by lockdown boredom. In the course of the past week, several users called on the online portal reddit in a forum for young hobby speculators (wallstreetbets) to buy Gamestop shares – initially only to save the price of the troubled group and to bring losses to major investors.

Gamestop benefits from the short-term dispute about its own stock market price. The stock is basically, but this much is certain, by no means worth the money currently on offer.

David versus Goliath

That worked extremely well: The share, which is on the decline, jumped from 18 to more than 460 US dollars. A huge problem for Melvin Capital: As a result of this stock market duel, they suffered billions in losses within a few days.

The people who gather on reddit practice trading on the stock exchange primarily as a hobby, as a sideline. Now this generation is feeling for the first time what power it can exert on the market if only enough of them gather behind a cause.

It is their stated goal to drive Melvin Capital into bankruptcy – and in the best case to get out with a hefty profit. Because this is becoming more and more likely due to the rising price, experienced brokers and speculators who are after quick money are jumping on the bandwagon.

Intervention of the mighty?

Then on Thursday evening the bang: Robinhood , one of the largest providers of online trading in securities and other forms of investment, forbade its users to buy more Gamestop shares on their own website. But you were still allowed to sell, which Melvin Capital naturally played into the cards.

The anger of the online community erupted with full force, and two hours later the purchase was possible again. The Gamestop rate had already collapsed by a whopping 330 dollars in this short period of time. Robinhood announced on Friday that they had simply underestimated the onslaught of users and had to come up with new capital in the two hours.

“The way it went, the incident is, of course, massively damaging your reputation,” said Bankaustria chief analyst Monika Rosen to the KURIER.

But there is one piquant detail: The company is owned by another hedge fund called Citadel – and it is said to have bought several billion US dollars worth of shares from its competitor, Melvin Capital, which was on the verge of bankruptcy a few hours before the purchase ban.

When this rumor started spreading, the outcry was great. Worldwide. Robinhood received class action lawsuits, including allegations of market manipulation. For the first time in a long time, you could even see how several US MPs from both parties were in public agreement: For example, it is rare (not to say: never) that the Texan Senator Ted Cruz and his adversary Alexandra Ocasio-Cortez from New York matches.

Fully agree. 👇 https://t.co/rW38zfLYGh

– Ted Cruz (@tedcruz) January 28, 2021

The affirmative comment of the right-wing hardliner does not seem to have smoothed the waves after the storm on the Capitol, which was also instigated by Cruz's statements:

I am happy to work with Republicans on this issue where there's common ground, but you almost had me murdered 3 weeks ago so you can sit this one out.

Happy to work w / almost any other GOP that aren't trying to get me killed.

In the meantime, if you want to help, you can resign. https://t.co/4mVREbaqqm

– Alexandria Ocasio-Cortez (@AOC) January 28, 2021

So the topic has finally become a political issue. In the end, the reputation of the stock exchange is likely to suffer, as Monika Rosen believes: “Of course, the whole incident doesn't help to objectify the debate about market transparency on the stock exchange.” It will be interesting to see how the fight develops next week.